The Facts About Stonewell Bookkeeping Revealed

Wiki Article

The 6-Minute Rule for Stonewell Bookkeeping

Table of ContentsFascination About Stonewell BookkeepingStonewell Bookkeeping Fundamentals ExplainedThings about Stonewell BookkeepingStonewell Bookkeeping - TruthsThe 45-Second Trick For Stonewell Bookkeeping

Instead of going via a declaring cupboard of various papers, billings, and receipts, you can provide detailed documents to your accountant. After using your accountancy to submit your taxes, the IRS may choose to execute an audit.

That funding can be available in the form of proprietor's equity, gives, business fundings, and financiers. Yet, financiers need to have a great idea of your organization prior to investing. If you do not have audit documents, financiers can not determine the success or failure of your firm. They need up-to-date, exact info. And, that details requires to be conveniently easily accessible.

The 7-Minute Rule for Stonewell Bookkeeping

This is not planned as lawful suggestions; for more details, please go here..

We addressed, "well, in order to understand just how much you need to be paying, we need to understand how much you're making. What are your incomes like? What is your net income? Are you in any financial debt?" There was a long time out. "Well, I have $179,000 in my account, so I presume my net earnings (earnings much less go to website expenses) is $18K".

7 Simple Techniques For Stonewell Bookkeeping

While it could be that they have $18K in the account (and also that may not hold true), your equilibrium in the financial institution does not always establish your revenue. If a person got a give or a financing, those funds are ruled out profits. And they would certainly not infiltrate your income statement in establishing your earnings.

While it could be that they have $18K in the account (and also that may not hold true), your equilibrium in the financial institution does not always establish your revenue. If a person got a give or a financing, those funds are ruled out profits. And they would certainly not infiltrate your income statement in establishing your earnings.Several things that you assume are expenditures and deductions are in truth neither. A correct set of publications, and an outsourced bookkeeper that can correctly classify those deals, will aid you recognize what your organization is truly making. Accounting is the procedure of recording, identifying, and arranging a business's monetary purchases and tax obligation filings.

An effective company needs help from experts. With realistic objectives and an experienced bookkeeper, you can conveniently resolve obstacles and keep those worries at bay. We dedicate our energy to ensuring you have a strong monetary structure for development.

Top Guidelines Of Stonewell Bookkeeping

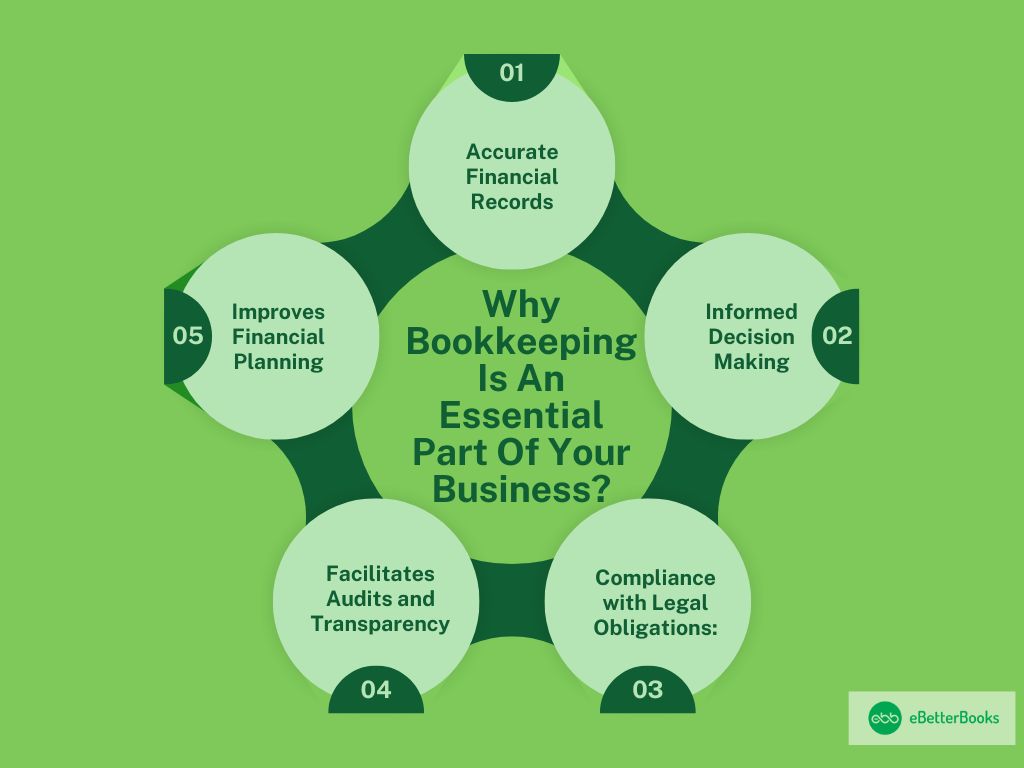

Precise accounting is the foundation of great economic monitoring in any service. With excellent bookkeeping, businesses can make better choices since clear economic records offer beneficial data that can lead method and increase profits.Exact financial statements build trust with loan providers and financiers, boosting your opportunities of obtaining the funding you require to grow., businesses must on a regular basis reconcile their accounts.

They ensure on-time settlement of expenses and quick consumer negotiation of billings. This improves capital and assists to avoid late penalties. An accountant will go across bank statements with internal documents a minimum of once a month to discover blunders or inconsistencies. Called financial institution reconciliation, this procedure ensures that the financial documents of the firm match those of the financial institution.

Money Circulation Statements Tracks money activity in and out of the company. These records assist organization owners comprehend their economic setting and make educated choices.

Stonewell Bookkeeping Things To Know Before You Buy

The ideal option depends upon your spending plan and company requirements. Some local business proprietors like to handle accounting themselves utilizing software program. While this is affordable, it can be time-consuming and vulnerable to errors. Devices like copyright, Xero, and FreshBooks allow entrepreneur to automate bookkeeping jobs. These programs assist with invoicing, bank settlement, and economic coverage.

Report this wiki page